Have your say on

our rates and debt

Council’s proposed option

Accept that our rates need a significant increase in the year ahead to manage the significant increase in costs set out in our consultation document.

To proceed with everything we’re proposing we would need to collect an additional $8 million or 15.7% in total rates for this coming year. That is after focussing on the MUST DO projects, increasing our fees and charges (more user pays), smoothing out costs where it makes sense to do so, and making changes to how we manage our roading budget and not fully funding the replacement of some assets (i.e. taking more risk in our approach in order to make things more affordable).

Through this consultation process, we expect the Community to tell us what changes you want to see made to our proposals. Underlying though, are the large increases in three-water related costs that we have little discretion over

Our district is not alone in facing these significant cost increases over the next 10 years, and our community is not alone in facing the rating impact of this. But we don’t believe it’s sustainable to keep rates artificially low, when the costs to deliver our basic services are increasing at the rate they are. For that reason, we believe the proposed rate increases strike a financially sensible balance between keeping rates as low as we reasonably can while enabling us to catch-up on the growing demands that increased Government regulation, growth in our district and current economic conditions have created.

Alternative option

Borrow money to help cover the high increase for the year ahead

Costs for everything are extraordinarily high right now - and we know that no one will welcome a significant rates increase. An alternative option is to borrow money to help cover the high operational costs for the year ahead, and pay this back over the following years. This is a bit like taking a personal loan to pay for the groceries when things are tight at home.

This option would result in an increase of debt of up to $3.98 million by year two (2025/26), which would then be repaid by year five (2028/29). Even with this additional debt, we could stay within our debt proposed limits on outlined above. The additional debt would incur interest costs, averaging $91,000 over the five years.

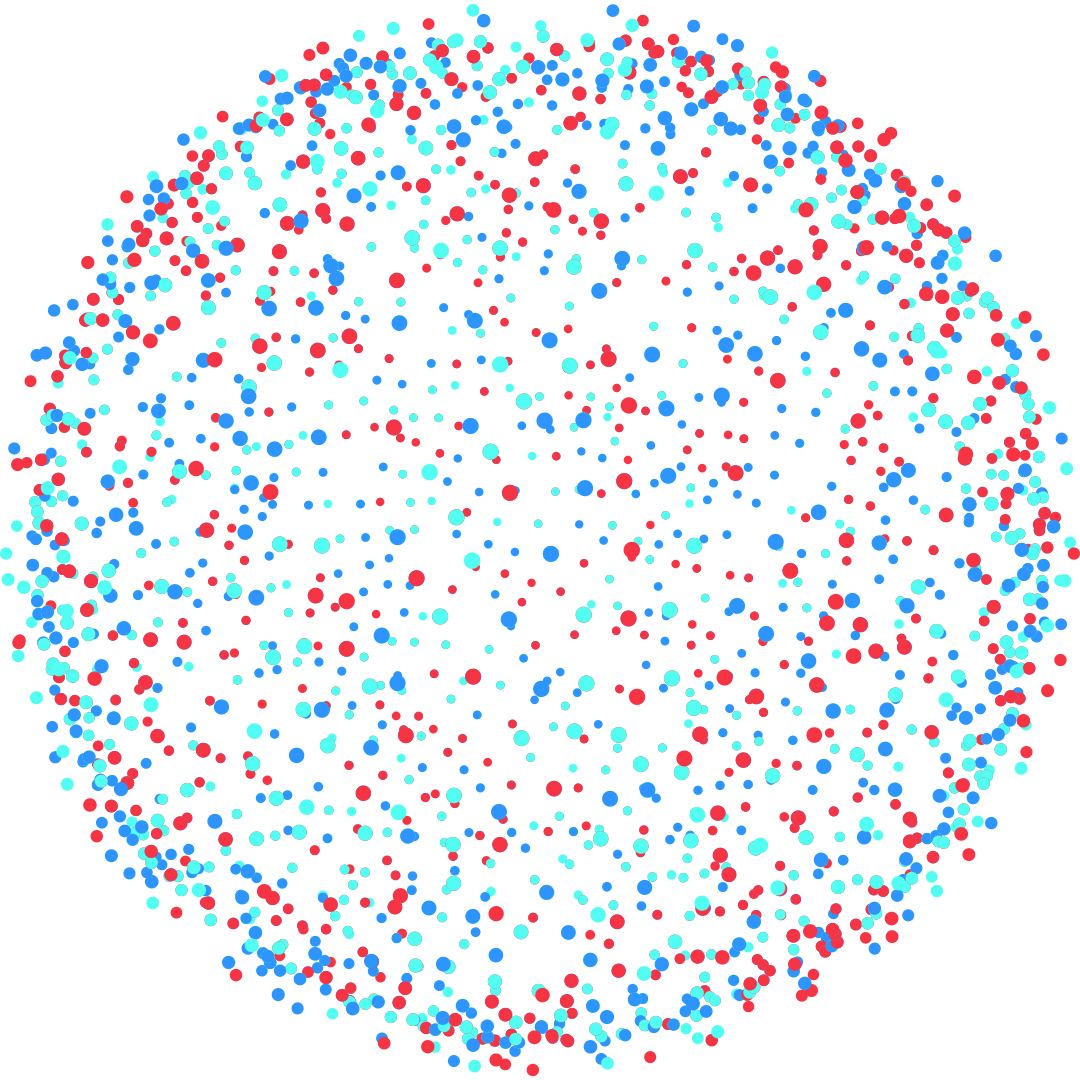

Rather than the proposed total rate increases of 15.7%, 6.3% and 5.8% over the first 3 years, we could spread that initial hit, by keeping the rate increase to 10% for each of the first three years by borrowing the funds and then repaying them over 5 years. This would mean a lower increase in year one and two, but higher increases in the years to follow. See the following table and graph for a comparison of how this option would impact rates compared to our proposed option.

While this option would ease some of the immediate pressure, it would mean playing catch up in the years to come, and sometimes we don’t know what is around the corner. In terms of sustainability, it is not an ideal way to manage our day to day costs for the longer term.

Understanding how these two options would impact rates

The following table illustrates the percentage increase in total rates over the next ten years for the two options outlined above. ‘Total rates’ is how much we would need to collect in rates to deliver everything proposed in this plan. The actual percentage increase will vary significantly depending on the value of your property and the services you receive.

The alternative option would reduce rates in the first two years, then recover the shortfall over the next three years including interest costs, which for this $700,000 property example would total $26.30.